Sell-side advisory

Experts in advising companies with annual turnover exceeding US $15 million.

Why sell my company?

There are several reasons why shareholders may decide to sell their company:

To obtain liquidity, usually owners of companies have a large part of their assets tied to a privately held illiquid business. A sale of the company, either partial or total, provides the liquidity owners are looking for.

No clear succession plan, companies without a clear succession plan for management or companies that are conflicted with their current management may seek to sell the business.

Strategic reasons, in order to maintain or increase its competitive advantages, a business may want to merge with a strategic buyer. Such union can help the company scale, create synergies or open new markets.

Complex situations, the company may be in a complex situation, with liquidity problems that cannot be solved through a financial or operational restructuring.

A company’s sell-side process is carried out following a broad-approach process, designed to maximize the value of the business by involving a high number of potential investors.

In such process, ZIMMA will contact several potential buyers globally and invite them to participate in an orderly manner. The benefits of a broad-approach include:

- Maximize the sale price, by generating greater demand for the company and, therefore, more competitors equals purchase price maximization.

- Increases seller bargaining power, by having control of the process time as well as several investors on the table, the seller will have more power to negotiate an offer that suits him best.

100+

Successful transactions

50+

Years of expertise

ZIMMA maximizes the value of the company for its shareholders by:

- Creating competition between local and global players.

- Coordinating an orderly and efficient process.

- Organizing attractive financial structures for the parties involved.

- Negotiating in an informed manner.

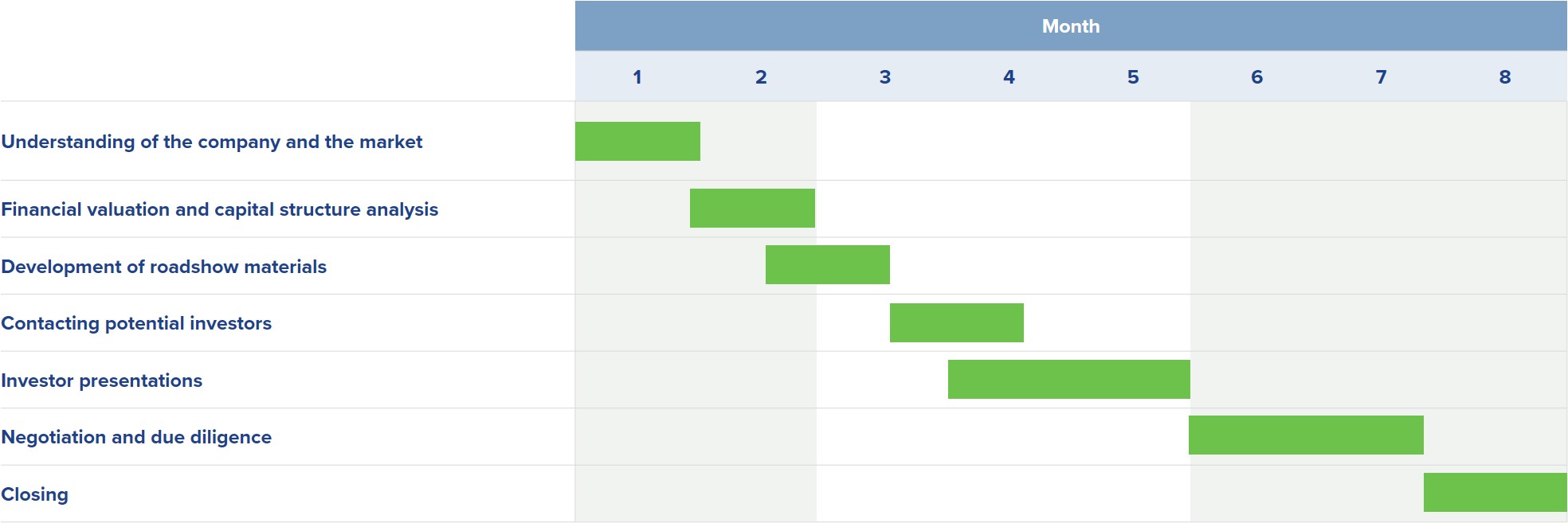

Company sale process

During the initial stage of the process, ZIMMA carries out an in-depth analysis of the company to understand its business model, value drivers, operations, distribution channels, customers, technologies, and future strategies. Likewise, an exhaustive analysis of the market is performed in terms of direct and indirect competitors, costs, margins, barriers to entry, and trends in order to better understand the context in which the company operates.

The first stage of the process sets the basis for a successful execution.

A deep knowledge of a company allows ZIMMA to address weaknesses and correctly position the company among potential investors.

ZIMMA develops financial models and analyzes the capital structure of the company to compute a precise valuation that can be sustained during a negotiation. In order to determine such valuation, globally accepted methods are used, including discounted flows, precedent transactions, and comparable public company multiples.

An accurate valuation of the company allows ZIMMA to negotiate assumptions that maximize the value of its customers.

ZIMMA prepares high-detailed materials that clearly present the company to potential investors. First, an investment proposal or teaser is prepared, consisting of an anonymous and confidential summary of the company, including its most relevant operational and financial attributes. Secondly, an investment memorandum is prepared, which explains every aspect of the company in detail so that investors can analyze the opportunity correctly prior to presenting a non-binding offer.

A precise communication about the company’s characteristics allows ZIMMA to generate appetite in the market.

Throughout this stage of the process, ZIMMA, together with the Oaklins global network, contacts institutions and companies that might be interested in investing in the company.

ZIMMA generates competition between local and foreign investors to maximize the value of the company.

ZIMMA, together with the client, present the descriptive materials to investors or institutions that are interested in the transaction. During the presentation or in subsequent sessions, additional inquiries that investors may have about the company are tended.

ZIMMA coordinates presentations and Q&A sessions with potential investors to answer inquiries that may arise during the transaction.

Once there is a serious proposal by one or more investors, ZIMMA coordinates and facilitates the flow of information to potential investors. Also, ZIMMA supports the company in selecting the most appropriate advisors (legal, tax, environmental, etc.) and in preparing final closing documents. During this stage of the process, ZIMMA and the other advisors guide the client in order to reflect terms that are favorable for the company.

After having participated in over 100 transactions, ZIMMA perfectly understands the negotiation strategy to follow to obtain the best possible terms and conditions for its client.

Throughout the closing stage, ZIMMA assists the company and its legal, tax and accounting advisors in all preparations that are required for successfully closing the transaction.